MIFIDPRU Disclosure

BACKGROUND

This disclosure is made in accordance with the UK Financial Conduct Authority’s (FCA) new Investment Firm Prudential Regime, which came into force on 1 January 2022.

The aim of this disclosure is to inject market discipline on firms by requiring them to disclose information to key stakeholders and counterparties. The key information will cover the firm’s financial strength, investment policy and culture.

FREQUENCY

This Disclosure will be reviewed on an annual basis as a minimum.

SCOPE

The disclosures in this document are made in respect of PPM Wealth which provides financial advice and discretionary investment management services.

RISK MANAGEMENT OBJECTIVES AND POLICIES

PPM Wealth has a low-risk appetite which is set by the firm’s Directors and is illustrated by the business strategy.

Our risk management policy reflects the FCA requirement that we must manage a number of different categories of risk. The firm’s risk assessment matrix details all of the processes in place to manage risk. In general terms risk management is done on a rolling basis and the continuous reviews in conjunction with the auditors and compliance consultants ensure that any harms as a result of these risks would be highlighted in a timeous manner. These include liquidity, credit, business and operational risks.

1- LIQUIDITY RISK

PPM Wealth’s liquidity is in the form of cash deposits, consequently the potential for harm is minimal. The banks used to deposit the firm’s cash are also regulated by the FCA. The firm manages all cash to maximise potential interest income whilst ensuring the firm has sufficient liquid resources to meet the continued operating needs of the business. The firms has no requirement to borrow cash. This is supported by a bi-monthly budgeting and forecasting process which has the full involvement of the senior management team.

2- CREDIT RISK

The firm’s revenues include annual management charges received from clients based on a percentage of client assets under management. These charges are made directly to the clients’ portfolios and therefore the credit risk relating to this income is minimal.

3- BUSINESS RISK

The firm’s business risk assessment principally takes the form of a fall in assets under management following a market downturn that results in lower management fees. Systems failures are also considered, although deemed very low risk given our business model. To mitigate our business risk, we regularly analyse various economic scenarios to model the impact of economic downturns on our financial position.

4- OPERATIONAL RISK

Operational risk is defined as the potential risk of financial loss or impairment to reputation resulting from inadequate or failed internal processes and systems, from the actions of people or from external events.

Major sources of operation risk include outsourcing of operations, IT security, internal and external fraud, implementation of strategic change and regulatory non-compliance.

The firm operates a robust risk management process which is regularly reviewed and updated with details being provided to all staff. The firm’s Compliance Oversight is responsible for the periodic reviews and recommending any changes to the Board. All senior management take responsibility for internal controls and the management of business risk, as part of their accountability to the board.

Individuals are responsible for identifying the risks surrounding their work, implementing controls over those risks and reporting areas of concern to their line manager.

The Compliance Oversight will provide the board with a half-yearly summary report on all significant risk issues.

5- CONCENTRATION RISK

PPM Wealth have a broad spectrum of clients with none representing more than 6% of our income. PPM Wealth does not deal on its own account and does not hold client money or assets, so this risk does not apply. Mitigation measures in place are to grow the business to ensure that this remains the case.

6- OTHER RISKS

The firm operates a simple business model. Accordingly, many of the specific risks identified by the FCA do not apply.

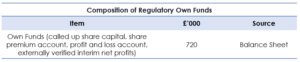

OWN FUNDS

OWN FUNDS REQUIREMENT

PPM Wealth are expected to maintain a minimum baseline capital known as their Own Funds Requirement (OFR). This is calculated by applying the higher of the following:

– Permanent minimum capital requirement; or

– Fixed overhead requirement

PPM Wealth is categorised as MIFIDPRU Investment Firm – Small Non-Interconnected Firm and so the permanent minimum capital requirement is set at £75,000 as at 31 March 2022.

In our case, it is the Fixed Overhead Requirement (“FOR”) which is applicable, and it is this amount that PPM are required to hold to satisfy the regulatory requirements. The FOR is meant to be a proxy for winding-down costs for a firm such as ours. When assessing the adequacy of our regulatory capital, we need to examine whether this amount would cover all the costs of winding-down the business in a manner that ensures all client interests are protected. PPM Wealth has a Fixed Overhead requirement of £197,000.

The firm’s capital requirements are determined by the outcome of its ICARA process.

Our overall approach to assessing the adequacy of our internal capital is set out in our ICARA. This process involves separate consideration of risks to our capital combined with stress testing using scenario analysis. The level of capital required to cover risks is a function of impact and probability. We assess impact by modelling the changes in our income and expenses caused by various potential risks over a 1–3-year time horizon. Probability is assessed subjectively.

Our own assessment of the minimum amount of capital that we believe is adequate against the risks identified, has been assessed as greater than the permanent minimum requirement. There is a considerable surplus of reserves above the capital resource requirement deemed necessary to cover the risks identified.

REMUNERATION DISCLOSURE

In accordance with the definition set out in SYSC 19G1.24G of Remuneration Staff, this Policy Statement confirms that PPM Wealth has no members of staff who would fall within this definition.

We also confirm that we don’t award remuneration through alternative vehicles or structures which attempt to avoid the rules.

Our Remuneration Policy is such that all individuals employed by the company are remunerated according to their role and to their contribution to the business, as determined and assessed by the Directors of the business.

Our remuneration practices promote sound and effective risk management, and don’t encourage risk-taking by any individuals within the firm which exceeds the firm’s levels of risk tolerance.

How our staff are remunerated has been designed to avoid any conflicts of interest.

We can confirm that our Remuneration Policy forms part of our overall risk management strategy, and is in line with our business strategy, objectives, values and long-term interests and as such is gender neutral.